UPDATE – Feb 18, 2013 – Fiscal Cliff Cuts In Deductions Will Affect Many – WSJ

The “Fiscal Cliff Deal” by Joseph Henchman of The Tax Foundation, January 01, 2013

At 2AM this morning, the Senate passed H.R. 8, the American Taxpayer Relief Act of 2012, by a vote of 89-8. Voting no were Bennet (D-CO), Carper (D-DE), Grassley (R-IA), Harkin (D-IA), Lee (R-UT), Paul (R-KY), Rubio (R-FL), and Shelby (R-AL). Not voting were DeMint (R-SC), Kirk (R-IL), and Lautenberg (D-NJ). TaxProfBlog has the text of Senate-passed bill (157 pages). The Joint Committee on Taxation (JCT) has also produced a revenue estimate, as has the Congressional Budget Office (CBO). The House of Representatives is expected to vote on the bill today sometime. (UPDATE: Just after 11pm, the House of Representatives voted 257-167 to adopt the Senate bill without amendment. The President signed the bill into law on January 3.)

Because the tax cuts were scheduled to expire anyway, JCT scores it as a $3.9 trillion tax cut over 10 years; compared to current policy, however, it is a $620 billion tax increase (plus $15 billion in spending cuts according to JCT, or minus $57 billion in spending increases according to CBO). (More details on the fiscal cliff and the 10-year budget estimates here.)

Key elements of the deal:

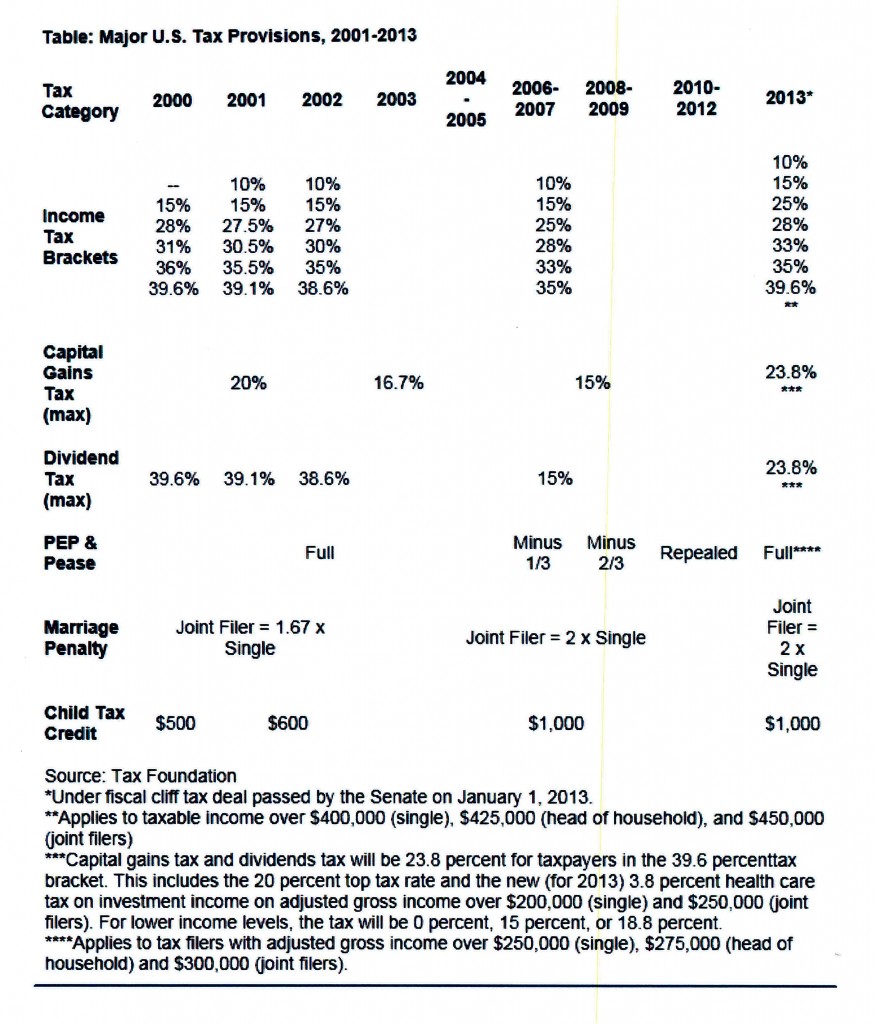

- Retains the 10 percent, 15 percent, 25 percent, and 28 percent income tax brackets from the Bush tax cuts permanently

- Retains the 33 percent and 35 percent income tax brackets from the Bush tax cuts for taxable income under $400,000 (single), $425,000 (head of household), and $450,000 (joint filers). Imposes 39.6 percent tax rate on income above this level.

- Phases out personal exemptions (PEP) for adjusted gross income over $250,000 (single), $275,000 (head of household) and $300,000 (joint filers)

- Limits itemized deductions (Pease) for adjusted gross income over $250,000 (single), $275,000 (head of household) and $300,000 (joint filers)

- Capital gains tax and dividends tax will be 20 percent for taxpayers with income over $400,000 (single) and $450,000 (joint filers). This does not include the new 3.8 percent health care tax on investment income above $200,000 (single) and $250,000 (joint filers) in adjusted gross income, so the top rate for capital gains and dividends will be 23.8 percent. For lower income levels, the tax will be 0 percent, 15 percent, or 18.8 percent.

- Continues setting the standard deduction for joint filers at 2 times single filers (would have otherwise reverted to 1.67 times single filers)

- Permanently sets Alternative Minimum Tax (AMT) exemption at $50,600 (single) and $78,750 (joint filers) for 2012 and adjusts for inflation thereafter

- One year extension of 50 percent bonus depreciation rules

- Extends American Opportunity Tax Credit (education) through 2017

- Extends the various “extenders” tax incentives through 2013

- Retains the doubled child tax credit ($1,000) permanently, its refundable portion through 2017, and the expanded earned income tax credit (EITC) through 2017

- Raises estate and gift tax to 40 percent, but above the current exemption level (~$5.12 million) and adjusted for inflation in future years

- Extends emergency unemployment compensation (EUC) and extended benefits (EB) unemployment insurance program through January 1, 2014

- One year “doc fix” for Medicare payment physicians

- Extends existing agricultural programs for one year (preventing the “dairy cliff”)

- Postpones sequester by two months; will now occur on March 27, 2013 (same day as the continuing resolution expires)

- Permits 401(k) plan participants to convert their plan to a Roth plan, under which contributions are taxed going in but withdrawals are tax-free. The result is a short-term revenue boost now and more tax-free savings accounts.

- Ends 2 percent payroll tax cut; taxpayers should expect greater FICA withholding from their next paycheck.

- No action on the debt ceiling. The U.S. hit the debt ceiling on New Year’s Eve, although Treasury actions to juggle books and defer payments will forestall default until late February. Biden has reportedly pledged to liberal Democrats that the President will not negotiate over the debt ceiling.

Additionally, the House is considering a bill to cancel the scheduled congressional pay increase (from $174,000 to $174,900) and to continue the 2-year non-military federal employee pay freeze for another year. President Obama issued an executive order on December 27 to raise pay by 0.5 percent beginning April 2013.

UPDATE: There’s a rumor that the Senate bill has a “benefit recapture” provision, applying the 35% rate to all income for high-income individuals. This is not true. The alleged provision, on page 7 of the Senate bill, exists because the new 39.6% top rate is not in the tables where it ought to be, but in a different section. The provision thus states that the 35% rate applies to all taxable income from the dollar amount where the highest rate bracket begins for each filing category, up to the threshold for the 39.6% rate. It also clarifies that the 39.6% rate applies to taxable income. There is no provision stating that lower amounts of income are subject to the 35% rate. (They presumably have different rate tables because 10-15-25-28-33-35 rate bracket levels inflation-adjust from a different base year than the new 39.6% rate bracket level, which will inflation-adjust from 2013.)

| Table: 2013 Taxable Income Brackets and Rates Under H.R. 8 as Amended by Senate | |||

| Rate | Single Filers | Married Joint Filers | Head of Household Filers |

| 10% | >$0 | >$0 | >$0 |

| 15% | >$8,925 | >$17,850 | >$12,750 |

| 25% | >$36,250 | >$72,500 | >$48,600 |

| 28% | >$87,850 | >$146,400 | >$125,450 |

| 33% | >$183,250 | >$223,050 | >$203,150 |

| 35% | >$398,350 | >$398,350 | >$398,350 |

| 39.6% | >$400,000+ | >$450,000+ | >$425,000+ |

Source: Tax Foundation*Under fiscal cliff tax deal passed by the Senate on January 1, 2013.**Applies to taxable income over $400,000 (single), $425,000 (head of household), and $450,000 (joint filers)***Capital gains tax and dividends tax will be 23.8 percent for taxpayers in the 39.6 percenttax bracket. This includes the 20 percent top tax rate and the new (for 2013) 3.8 percent health care tax on investment income on adjusted gross income over $200,000 (single) and $250,000 (joint filers). For lower income levels, the tax will be 0 percent, 15 percent, or 18.8 percent.

****Applies to tax filers with adjusted gross income over $250,000 (single), $275,000 (head of household) and $300,000 (joint filers).

| Table: Estate Tax Rates & Exemption Levels, 2000-2013 | ||

|

Estate tax (top rate) |

Estate tax exemption |

|

| 2000 |

55% |

$675,000 |

| 2001 |

55% |

|

| 2002 |

50% |

$1,000,000 |

| 2003 |

49% |

|

| 2004 |

48% |

$1,500,000 |

| 2005 |

47% |

|

| 2006 |

46% |

$2,000,000 |

| 2007 |

45% |

|

| 2008 | ||

| 2009 |

$3,500,000 |

|

| 2010 |

Repealed |

Repealed |

| 2010-2012 |

35% |

$5,120,000 |

| 2013* |

40% |

$5,120,000 (or inflation-adjusted level) |

| Source: Tax Foundation; Internal Revenue Service.*Under fiscal cliff tax deal passed by the Senate on January 1, 2013. | ||

Curtain Falls on “Fiscal Cliff” Drama, or was it a Tragedy for Taxpayers? from the National Taxpayers’ Union

Pete Sepp

January 2, 2013

What’s the sound of one hand clapping? That’s probably the way many taxpayers reacted after reading news that Congress completed action to avoid some of the worst tax policy-related parts of the “fiscal cliff.”

Is an underwhelmed reaction justified, though? Supporters of the deal would remind us, middle-class taxpayer relief that was enacted in 2001 and 2003 was made permanent, a “patch” protecting 30 million American families from the Alternative Minimum Tax was cemented into place, and a gaggle of “extenders” was renewed for several years.

There were also a couple of nice surprises. Perhaps sensing their failure to provide leadership on reducing the national debt, lawmakers decided to keep their salaries frozen at $174,000 for the rest of the New Year, instead of accepting an automatic pay bump. Furthermore, the new law officially repealed a particularly repugnant feature of the 2010 health care law: the Community Living Assistance Services and Supports (CLASS) Act, a benefit program cynically designed to collect premiums as a spending offset in its early years while shifting costs beyond ObamaCare’s “scoring window.” Although the Administration announced last year that it would not implement the CLASS Act owing to its problematic financial condition, the scheme remained on the books until now.

The rest of the story is not as pretty. Here are several consequences of the fiscal cliff deal that will likely leave taxpayers jeering rather than cheering:

1) A new tax-rate bubble. Joint filers making less than $450,000 a year who think they’re safe from any kind of income tax increase should take another look at a bad old feature that will come back to haunt them: limits on itemized deductions and the phase out of personal exemptions. These provisions, gradually repealed under the Bush-era tax laws, will now hit married households at the $300,000 level – creating a “bubble” under the new 39.6 percent bracket.

One side effect of the bubble may be burst expectations for charities. Wealthier individuals may reconsider whether giving large financial gifts to worthwhile causes is … well … worthwhile anymore. Since many of nonprofit groups receiving the donations perform social services more efficiently and effectively than government agencies can, taxpayers at all income levels have cause for concern. Just as we opined in a December Issue Brief revaluating deductions and exemptions in the context of across-the-board tax reform is well and good; in the context of the fiscal cliff deal, however, lawmakers simply saw a $150 billion revenue-raising opportunity and took it.

2) A new 20 percent capital gains tax rate – or is it more? When President Obama kept stating on the campaign trail that he favored a top capital gains tax rate of no more than 20 percent, he was less than clear about whether or not this includes the 3.8 percent surtax on “unearned income” (whatever that is) that’s being triggered this year by the 2010 health care law. Now we know – the actual top rate will be 23.8 percent. Even worse, because the income thresholds are not synched, there could be capital gains rates of 0, 15, 18.8, 20, or 23.8 percent, depending on an individual’s situation. There will be other permutations with the upper income tax rates depending on how one is affected by the deduction and personal exemption phase outs. Which leads us to …

3) More complexity. Those who believe 2012’s tax returns are complicated enough had better hold on to their hats for the next filing season. High-income earners will have to perform many additional calculations for phase-outs and clawbacks. Additionally, the already difficult to decipher maze of middle-class credits remains largely untouched, and won’t improve unless Congress tackles fundamental tax reform. According to NTU’s most recent “Taxing Trend” study, Americans spent $228.4 billion just complying with the personal and corporate income tax system. Freeing up even part of this “deadweight loss” could help steer private-sector resources to more productive activities.

4) Other Obamacare tax hikes. Another provision with serious middle-class implications is the “haircut” on the tax deduction for medical expenses that will require taxpayers to prove a higher threshold of health care costs before claiming a write-off (10 percent of Adjusted Gross Income versus the previous 7.5 percent). Although this year seniors can keep taking the deduction at the less stringent 7.5 percent level, by 2016 they too will be subject to the new rules. In Tax Year 2010, 98.8 percent of the 10.4 million filers who wrote off medical expenses on their 1040 forms had incomes of under $200,000. Meanwhile, medical device manufacturers are planning to cope with a new excise tax by – no surprise – shrinking operations and jobs.

5) The end of payroll tax relief. The so-called “payroll tax holiday” was controversial for some fiscal conservatives, who argued that it would have few of the economic benefits that reductions in income or investment tax rates would have. Nonetheless, the holiday did provide a 2 percent boost for tens of millions of paychecks. Conversely, 2013 will begin with a 2 percent pay cut for all of these households.

6) Hidden spending. The Joint Committee on Taxation’s estimated revenue effects for the fiscal cliff package include some eye-opening (more like eye-popping) numbers for the impact that some proposals will have on future budgets. A case in point: refundable credits, which allow individuals to claim money in excess of their actual tax liabilities. Though many of these sound like pure tax provisions, they are actually spending items. For example, extensions for three separate categories of law affecting the “Earned Income Tax Credit” will equate to $36.3 billion in spending over the next ten years. The refundable portion of the child tax credit from Bush-era policies, plus the relaxed income thresholds for refundability under the Obama stimulus, add up to $184.7 billion over that same period. Again, these monies represent expenditures, not foregone revenues.

7) Farm program extensions. Congress may have averted a disaster by opting not to pour mammoth, near-trillion-dollar legislation authorizing new agriculture programs into the fiscal cliff package, but the one-year extension of current farm programs doesn’t do taxpayers or consumers many favors either.

One example of the dilemma Americans faced was with dairy policy. In reaction to Agriculture Secretary Vilsack’s highly suspect warning that milk prices would shoot to $7 a gallon unless the existing Byzantine milk pricing system was renewed, Congress renewed through the end of 2013 the Milk Income Loss Contract (MILC) program along with other dairy price support rules. That’s perhaps not as odious as the Dairy Market Stabilization Program (DMSP) proposed in the 2012 Farm Bill, but a far cry from a much better plan offered by Reps. Goodlatte (R-VA) and Scott (D-GA) last year that would have provided “margin insurance” for dairy farmers without a market-manipulating supply and demand control regime.

8) Tax favors for special interests. At the same time Congress voted to raise taxes on small businesses (Ernst and Young have pegged the job losses associated with the President’s tax hikes at 700,000), lawmakers also extended tax credits for everything from wind power to cellulosic biofuel to NASCAR. While not a direct, taxpayer-funded subsidy, using the tax code to prop-up pet projects distorts the marketplace and displaces what are often more economical, privately funded enterprises. Congress should be working to eliminate these breaks in the context of fundamental tax reform that offers lower rates and a simplified base. Instead, it opted to continue to use the tax code to pick winners and losers.

9) No entitlement reform. If Washington ever wants to get serious about cutting the deficit, the first item on the list has to be entitlements; the three giants, Medicare, Medicaid, and Social Security are the real drivers behind our debt. Opponents of entitlement reform conjure pictures of grandma eating cat food at the first hint of reform, but there are many commonsense proposals that would increase the longevity of the programs while at the same time reducing the taxpayer burden. Reining in fraud and waste, increasing the eligibility age, encouraging private insurers in the senior market, and block-granting Medicaid to the states are all good places to start. Instead of deriding such suggestions as cruel and reprehensible, legislators from both sides of the aisle need to face facts — we have an aging population, a struggling economy, and a serious debt problem with no money in the bank –and sit down for a serious discussion.

At the very least, Congress could have offset, with appropriate cuts elsewhere, the so-called “Doc Fix” for Medicare’s physician reimbursement rates. But once again elected officials resorted to their irresponsible behavior of undoing scheduled spending reductions and replacing them with nothing.

10) Sequester delay. Instead of having $109 billion in spending restraint take place immediately in the new year, Congress gave itself a two month reprieve, until March 1 to think of new reasons why there should be no end in sight for out-of-control spending. In November, 22 organizations joined with NTU to urge Congress not to delay or otherwise avoid the sequester because:

“Delaying this action will only make it harder to get our fiscal house in order, in the process weakening our economy, saddling future generations with debt, and further undermining Congress’s credibility to lead.”

Delaying the sequester was an important indicator of just how unwilling Washington is to tackle our biggest problem: spending. Despite the new revenues entrenched in H.R. 8, the CBO reports the “fiscal cliff” deal will add nearly $4 trillion to the deficit, confirming fiscal conservatives’ fears that higher taxes will do nothing to defray our sky-high debt.

Altogether, this deal was less a turnaround from the cliff than it was a swerve. And now, on to the spending side of canyon … will Congress keep putting its foot down on the gas or truly change direction by easing up on the budget accelerator?